Step No. 1: Log in to your GST account in GST Portal with valid credentials

Step No. 2: Go to services tab and click on Returns Dashboard

Step No. 3: Select the month for which the return is to be

filed

Step No. 4: Select the tile “Monthly Return GSTR3B” and

click on Prepare Online

Step No.5: Please answer the following questions to enable

us to show relevant sections:

A. Do you want to file Nil return? [Note: Nil return can be filed by you if you have not made any outward supply (commonly known as sale) AND have NOT received (commonly known as purchase) any goods/services and do not have any tax liability.]

B. Have you made any supply of goods/services (including nil

rated supply under GST, exempt and Non- GST supplies) or received any supplies

liable to reverse charge during this tax period? (Table 3.1)

C. Have you made any inter-state supplies to unregistered

persons, composition taxable persons or UIN holders? (Table 3.2)

D. Do you have any claim/reversal of Input tax credit (ITC)

on purchase of goods or receipt of services? (Table 4)

E. Have you received any nil rated, exempt or non-GST

supplies during this tax period? (Table 5)

F. Do you have any interest or late fee (including carry

forward late-fee) liability? (Table 5.1)

G. Do you have any tax liability due to GST TRAN-1?

(System-populated) (Table 6)

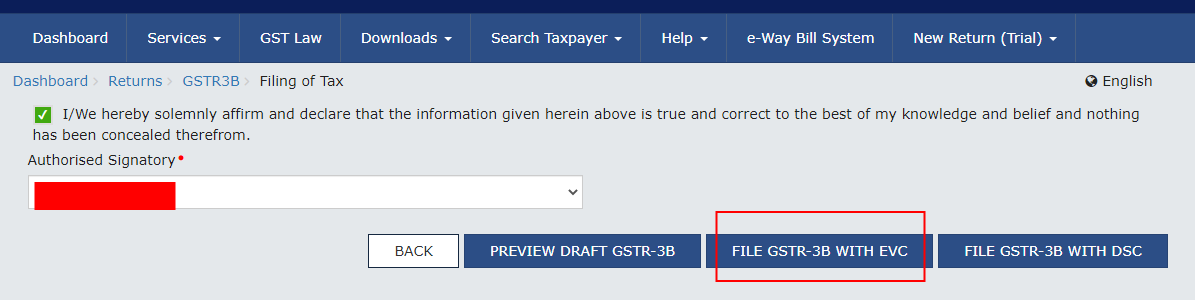

Step No.6: A Dialogue box will appear as follows:

I/We hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and nothing has been concealed therefrom.

[Note: If error is Shown "Please try after sometime", Then You will Wait for Sometime, After that you can refresh the page]

Tick the box and verify the return with EVC Option (With Aadhaar Card OTP) or DSC Option

Step No.7: Your GSTR-3B Nil return is filed after verification of the same.

[full_width]

No comments:

Post a Comment

If you have any query, please let me know